This is the tenth and final part of what is a 10–part series of blog posts, which will ultimately be published in full as a single report.

What about floating?

Floating has a bright future

Why do floating?

The notion of installing turbines on floating structures rather than foundations set on the seabed has been promoted for two main reasons:

- The first practical one is that there are actually not so many places like the North Sea, where relatively low depth waters extend for hundreds of kilometers from the coasts, offering a very large area where fixed‑bottom foundations can be installed. Alongside most coasts, waters get deep quite quickly, and turbines can either be installed very close to shore, with all the problems that can cause as they are visible and occupying areas at sea that are typically very busy with other activities, or not at all. This is in particular true in places like Japan, California or the Mediterranean, where fixed–bottom turbines have limited potential. So in order to do offshore wind at scale (and that is the main advantage of offshore wind after all), floating becomes the only route;

- The second argument is that floating offers the prospect of avoiding construction at sea altogether – an activity which is both inherently risky and expensive. Floaters can be built onshore; the turbine can be erected in the port and the structure can then simply be towed to its location, an activity requiring much simpler vessels (tug boats) than offshore installation of fixed–bottom turbines and much less sensitive to weather conditions. Additionally, this offers the possibility to do serial production of the floaters rather than having to manufacture multiple ad hoc foundations (as each fixed‑bottom structure needs to be tailor–made to the water depth and the soil conditions of its exact location).

Floating wind thus offers the hope of very large scale renewable power production away from the eyes of coastal populations and with the efficiency of an industrialised onshore supply chain.

Technology and risks

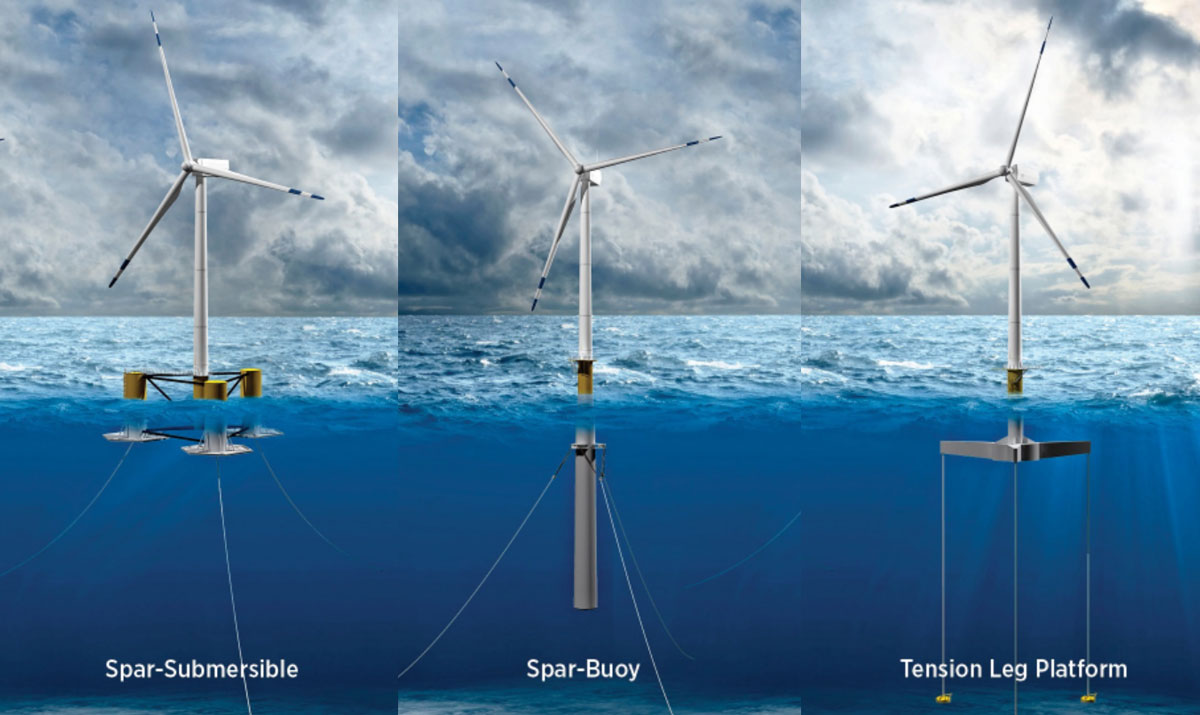

Several concepts of floaters exist. We will not discuss them in detail here but present them for illustrative purposes. They each have different constraints (such as minimum water depth to be installed, or quayside surface required).

These technologies are generally considered to work, from a technical point of view, but none have been tested in full as regards large scale manufacturing and installation, and their cost on a serial basis is not necessarily fully identified yet.

Figure 1 – floating platform technologies. Source: Josh Bauer/NREL

In any case, the risks are fairly similar (and to a reasonable extent conceptually similar to the risks faced by the fixed bottom offshore wind industry 15 years ago):

- It is again bringing together industries that have no experience working together – in this case, the specialized construction industry for floating structures with the wind turbine manufacturers, with neither able to take responsibility for the scope of the other;

- It creates new interfaces, in this case more during operations than construction: what is the envelope of conditions (in particular as regards verticality of the installation) where turbines will perform normally, and who is responsible if the turbine performs below expectations, or suffers more wear and tear? Are the contractors willing to provide guarantees, backed by financial commitments, in case of deviations?;

- There are specific questions about “dynamic cables” that would connect the platforms and collect the power generated – they will need to “hang” from the floaters before reaching down to the seafloor, and potentially again to reach a floating substation – with the high voltage cable bringing the power to shore facing a similar constraint from such substation. The vulnerability of these cables and potential risks of damage or failure are not fully measured yet;

- Finally, it generates new questions about potential bottlenecks in the supply chain. Large specialized vessels are no longer required, but very large quayside installations are needed to manufacture and store the floaters before the turbines are installed on them and they are shipped to see – such space is at a premium in many port facilities. With large scale deployment expected in the coming two decades, rapid growth will be necessary and not all parts of the supply chain may move at the same pace, potentially creating unbalances and slowing down some projects.

Figure 2 – Ideol floater under construction in St Nazaire (Source: Ideol)

Conceptually, these are questions that resemble those that banks asked 15 years ago about offshore wind: what could go wrong, what will it cost to correct it, and who is responsible? We are at a stage where everybody expects that all these questions have satisfactory answers, but the exact answers are not fully available and the uncertainty has a cost in terms of the availability of debt and the terms under which it can be provided.

Banks crave precedents, and we are back to a situation where there simply isn’t enough information available. The early prototypes have demonstrated that turbines work on floaters, and can produce electricity at high capacity factors (Hywind Scotland, a 5‑turbine pre‑commercial project off Scotland, announced a capacity factor of 57% for its second year of operation), but they have not really provided insights on what happens once serial production and installation is the norm.

Ironically, the fact that prototypes have been performing really well has not given information on what downside scenarios could look like (how much time does it take to tow a faulty turbine back to shore and repair it, how much does it cost, and how often it is likely to happen?); which makes it difficult for banks to assess the worst case situations that they would want the projects to be able to cope with.

Getting floating debt–financed is critical

Just like other renewables and fixed–bottom offshore, floating wind is a capital–intensive technology where most of the money is spent upfront and running costs are relatively low, which means that ultimately, the cost of electricity will be driven as much by the cost of capital as it will be by the cost savings generated by economies of scale. And both will only go down if projects happen.

The virtuous circle of any developing sector is as follows:

- R&D to prove that the technology works is typically funded by governments, providing grants to universities or the R&D teams of industrial players. These usually try to build prototypes (often at reduced scale) and get them to work (1‑turbine project, budget typically in the low double‑digit million euros);

- The next step is to build pre‑commercial projects, at scale, that can generate revenues, with government support in the form of construction subsidies and/or specific revenue regime (5‑10 turbine project, budget typically in the low triple‑digit million euros); these projects can be financed on a commercial basis but this will likely mean quite conservative terms; this generates more data on the technology, allows the supply chain to grow and to start working on manufacturing at scale (even if for small series to stat with);

- After that, the goal is to have larger fully commercial projects, ideally generating power at a price which is not too far from competitive technologies, in order to limit the support they receive, for instance via technology‑specific tariff auctions that do not force them to compete against more mature technologies. Such projects will be financed on terms that will slowly increase as the track record grows (and remain satisfactory); this allows to test manufacturing and installation on a serial basis and build up the supply chain accordingly

- Subsequent projects can grow from that basis, benefitting from improved economies of scale, less conservative assumptions/buffers as risks become better understood, and improved financing terms.

The big questions is how quickly can the virtuous circle of increasing scale and decreasing costs (both physical and financial) happen. Governments now see that onshore wind, solar and traditional offshore wind can be built with tariff levels that are comparable to spot market prices, and may wonder why they should force ratepayers to provide higher prices to another technology. Even if they are willing to give support to a new sector, they may get impatient if the cost reduction is not as spectacular as it has been for offshore wind in the 2015‑2020 period.

That question is still open today, even if it seems likely that countries like Japan, that simply have no other alternative to deploy renewable energy on a large scale, will support the sector long enough for it to become competitive. The recent Scotwind tender, where half the capacity was awarded to floating projects, should help accelerate the answers.

Conclusion

The history of offshore wind is quite intertwined with the history of how the projects were financed, and it is the rare sector where risks are quite significant (construction at sea will never be an easy task), where they have been taken willingly by banks, and where they have been successfully navigated by the industry, with an enviable track record of projects built on time and on budget.

This means that funding is available for the industry, on highly competitive terms, and is not a bottleneck for the further development of the sector – and the same will be true of the nascent floating offshore wind sector. Rather than being an obstacle, smart financial engineering has been one of the driving factors for the substantial drop in the cost of electricity generated by offshore wind farms, as the excellent risk management by the industry, prodded by careful financiers, has allowed to attract low-cost capital, an important feature for a capital–intensive sector.

As offshore wind becomes one of the dominant new sources of generation of clean electricity, it is worth celebrating this example of financiers doing their job of supporting an industry while understanding the risks they are taking!