This is part 2 of a multi–part series on the financing of offshore wind projects. It is best to read Part 1 first.

Offshore wind will always be complicated

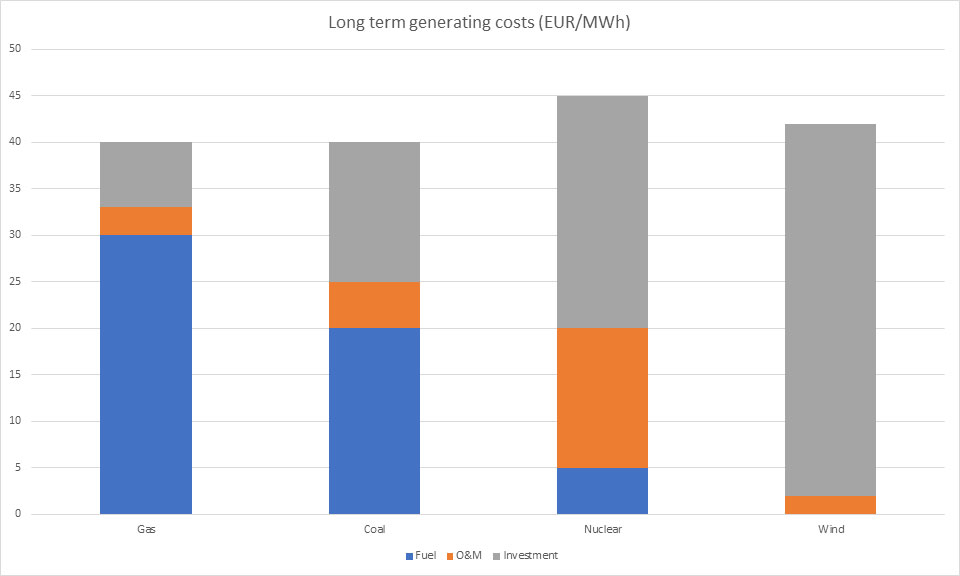

Figure 1: Main components of an offshore wind project (Source: Green Giraffe, S9)

Beyond the inherent difficulty of erecting heavy structures at sea, the offshore wind industry is remarkable in that it brings together industrial sectors that have nothing to do with each other, and cannot easily sub-contract work to each other. Turbine manufacturers and marine installation companies have very little to do with each other, and steel foundations, cables and heavy electrical equipment are all quite separate. More importantly, not a single component dominates in terms of overall cost or ultimate responsibility to make the project happen – all elements are critical, but none usually represents more than 30% of the construction budget. And the necessity to build at sea requires a very carefully choregraphed construction schedule, as most tasks can only be done in a very specific order.

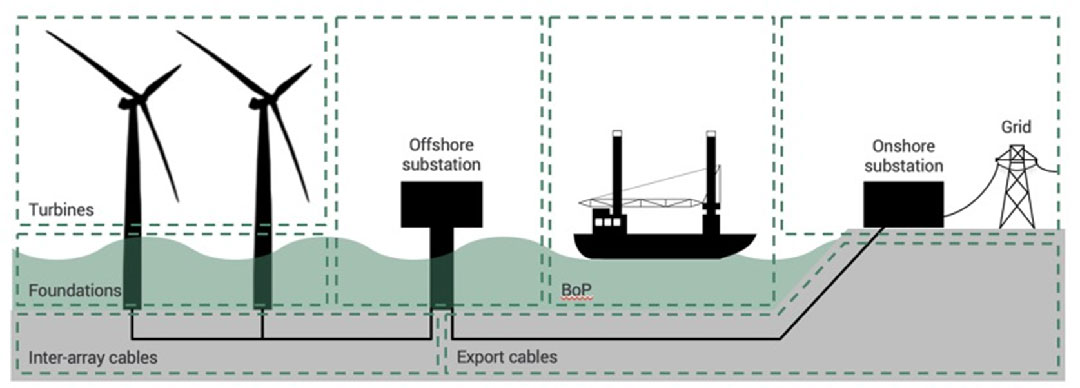

This creates interdependencies between multiple contractors and a large number of “interfaces” – points where the responsibility for the work needs to be transferred from one party to another. And these are physical interfaces between very different tasks or components: even if it is possible to find one party responsible for both it will need to manage the interface between these tasks carefully.

Figure 2: A simplified overview of interfaces in an offshore wind project. Source: Green Giraffe, Recent trends in offshore wind finance, April 2019, S6

WTG = wind turbine generators; FOU = foundations; IAC = Inter–array cables; EXC = external cable (to grid))

So in short – even if the industry has learnt to do it better, installing wind turbines at sea (at increasing distances from shore) is never going to be an easy undertaking and it will always require a lot of planning and precautions.

Wither project finance?

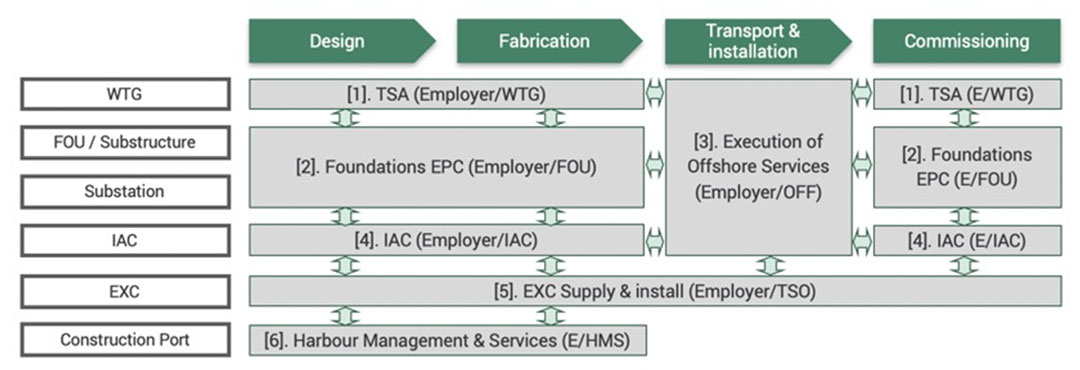

It is in that context that it should be noted that offshore wind, like most infrastructure projects, is capital-intensive: most of the money needs to be spent upfront to build the equipment, which then costs relatively little to operate and maintain. That means that once operational, the main cost is the repayment of the initial investment (whether as interest and principal on loans, or dividends to equity providers), and, as such, offshore wind’s long term cost base is (i) largely fixed from day 1, and (ii) highly dependent on the cost of capital.

Figure 3: The relative composition of the cost of electricity for different types of plants

Source: IEA World Outlook 2004, adapted by author. Old sources are voluntarily used, as they remind us that wind has been competitive against traditional power generation sources for close to two decades, but its economics are fundamentally different, and thus policies have struggled to integrate them easily into market designs.

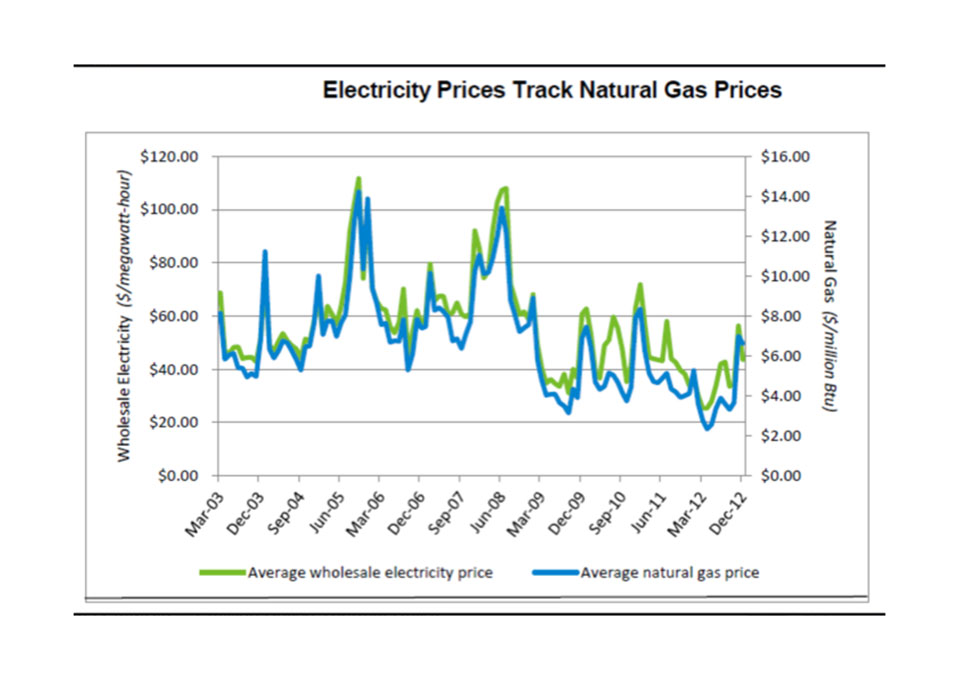

In one case, most of the cost is linked to the fuel that is burnt, i.e. it is avoidable but unpredictable, whereas in the other the cost is fixed, predictable and unavoidable. That means that fossil fuel plants, unless prevented for technical reasons, will choose at any point in time whether to produce power or not– they burn fuel only if it is profitable to do so. Their marginal cost of power is high and they are “price-makers” i.e. they will help determine the market price most of the time, as the most expensive plant required to balance the market will typically be such a plant, based (partly) on its technology and (largely) on the cost of the fuel required at that time.

Figure 4: Power prices closely track gas prices in liberalised markets (Source)

Conversely, renewables (like nuclear) are “must run”: it costs very little to produce an additional MWh (their marginal cost of production is very low), so they will do it as much as they can (as long as the underlying resource, wind or solar, is available, of course) and thus effectively bid a generation price of zero in the market (i.e. any price above that generates cashflow and is thus worth it): they are “price‑takers.” That means that they are almost always dispatched before fossil fuels (the exception are lignite plants, which are very inflexible, and hard to stop and re–start, and will thus typically bid negative prices to be sure they are not taken off the grid at any point in time.

In terms of economics, it means that the single biggest driver of the cost of electricity for renewables is the cost of capital. The lower the cost of capital, the cheaper it is to spread the initial investment over future production years. That explains why solar can be cheaper in Germany than in Spain (or in North Africa) despite the obviously weaker resource.

The cheapest form of capital is debt, so the more debt you can raise for a project, and the longer the maturity, the cheaper the electricity will be. This is where “project finance”, or “non-recourse finance” comes in. This is debt provided directly to a project, and repaid only by such project’s revenues, and not guaranteed by the project’s owners.

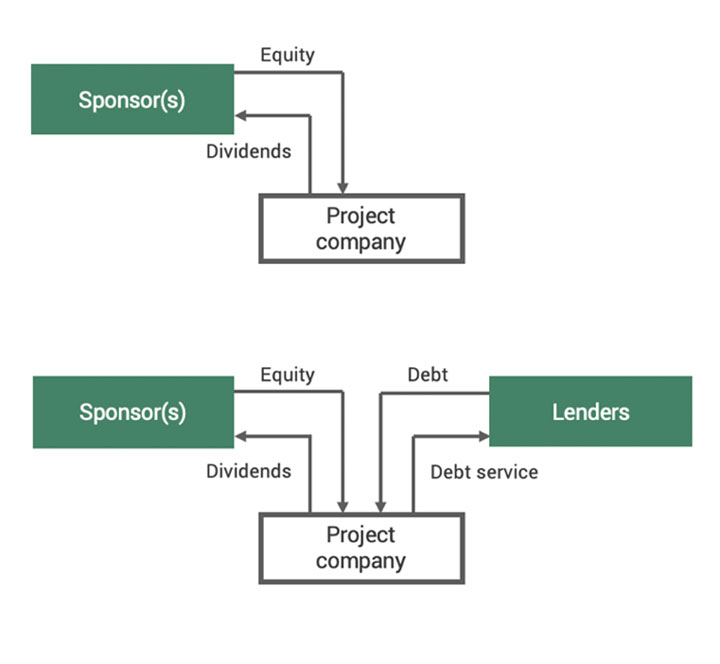

Figure 2: Balance sheet finance vs project finance Source: Green Giraffe, S4)

The cost of capital for a project-financed project is the weighted average of the cost of equity (over the life of the project) and the cost of debt (over the duration of debt), which makes it structurally lower than if you only invest with equity, and thus highly attractive for capital‑intensive projects. The cost of capital for a project funded on the balance sheet of an investor is itself the weighted average of the cost of the equity of that investor, and that of its corporate debt. The cost of equity for investors using non recourse debt is a bit higher than the cost of equity for sponsors investing directly in projects, but this is more than compensated for by the lower cost of the non recourse debt specifically provided to the project.

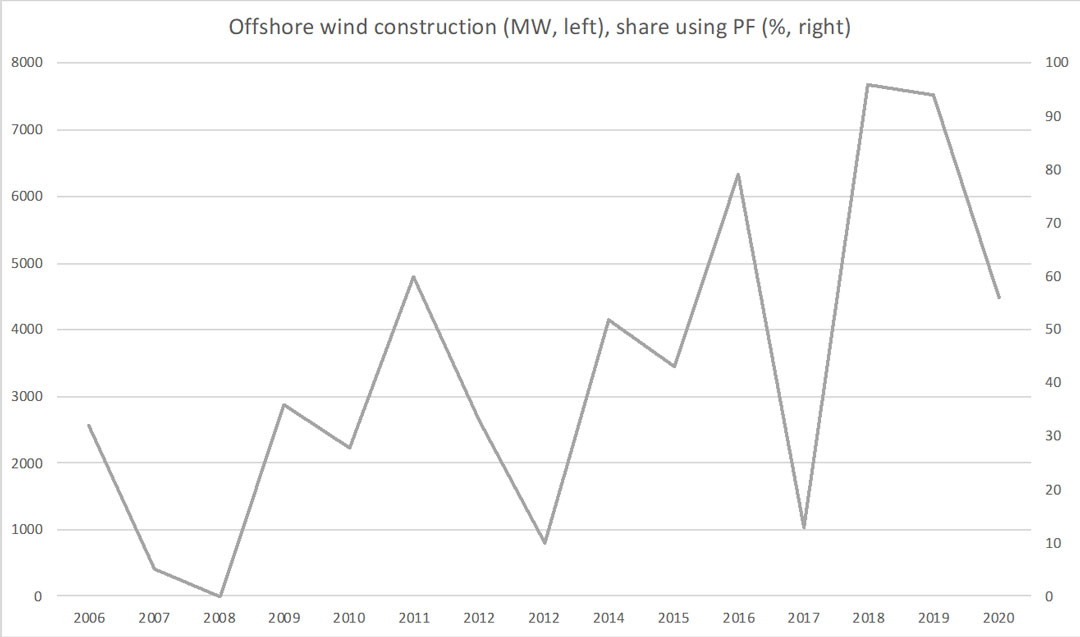

As the graph below shows, the proportion of projects using non–recourse debt has increased over the years, as the volume of projects built was increasing. The trend is not linear as projects are “lumpy” (they are very larger and a small number of projects in each category each year can change the data for that year materially) but the overall trend is clear.

Figure 5: Offshore wind construction (MW, left), share using PF (%, right)( Derived from “Offshore wind debt 15 years on”, PFI Yearbook 2022

So what’s the catch? Why are so many projects still built on balance sheet?

Well, given that lenders will only be repaid by the project itself, and not by anyone else, they want to make sure that the project actually gets built with the funds allocated for that purpose, and then generates enough revenues to service the debt. If they are further asked to take construction risk (which is not always the case – there are many infrastructure sectors where the investors prefer to keep that risk, and in offshore wind it has not been the case for all projects, as shown in the graph above), they will want to make sure that construction will happen on time and on budget. And in any case, they will want the project to be operated properly for a duration at least as long as the debt maturity, and to have enough revenues, i.e. enough production is sold at a high enough price. And in order to take these risks, they will want the different tasks and commitments to be allocated to the right parties and contracted in enough detail to cate for most circumstances.

That typically means intrusive involvement in the contractual set up of the project, and extensive “due diligence” i.e. technical, legal and other verifications by third party experts of every aspect of the project (its permits, technology, schedule, budget, personnel, and the markets it sells into). Not all investors are comfortable with such active participation of outsiders, let alone bankers, in what is usually their core area of competence.

In many sectors, investors use project finance to cover very narrow and specific risks: for instance, oil & gas companies use limited-recourse debt to share political and operational risk with banks, but not construction risk for projects in difficult countries. So they guarantee the repayment of debt in case of delays or cost overruns, but they ask the banks to shoulder some of the risk in case of expropriation, currency convertibility or transfer restrictions, or inability of the local governmental entities to fulfil their commitments.

Offshore wind is actually one of the few sectors where the banks have regularly been asked from the start to take complex construction risk on a non‑recourse basis. To some extent, this is a quirk of history – in several countries, small developers were able to get their hands on the first offshore wind sites and quite simply did not have the financial capacity to fund the full projects themselves, so they were willing to give potential lenders a lot of say in how the projects would be structured, as long as it actually made them happen.

This usually makes the construction contracts more expensive than when managed by balance sheet investors, as banks expect to see stronger warranties and commitments by the contractors, and costs such as project management are explicitly passed on to the project rather than being partly hidden/buried in the internal costs of the sponsors, but this is usually an acceptable trade–off against the lower overall cost of capital mentioned above.

In a stroke of luck for the sector, the first projects were financed in 2006-2007, before the financial crisis, at a time where banks were already quite enthusiastic about financing renewable energy (then a relatively new sector) but were not as constrained by the restrictions and the increased risk‑aversion that came after the crisis. That meant that the early transactions, which acted as precedents for the future market, were set in relatively favorable conditions, and this made the next projects, i.e. those post-crisis, that much easier, as there were already existing projects that could be used as (positive) reference points. It also helped that offshore wind started in the countries around the North Sea, which are all highly‑rated, stable democracies where banks were keen to do more business and have a tradition and the expertise of non–recourse lending.

In any case, that meant that banks were asked, from the very beginning, to take considerable risk on the construction side, in addition to all the traditional risks of such projects (as discussed in chapter 5), in a sector where there was very little visibility and very few precedents.

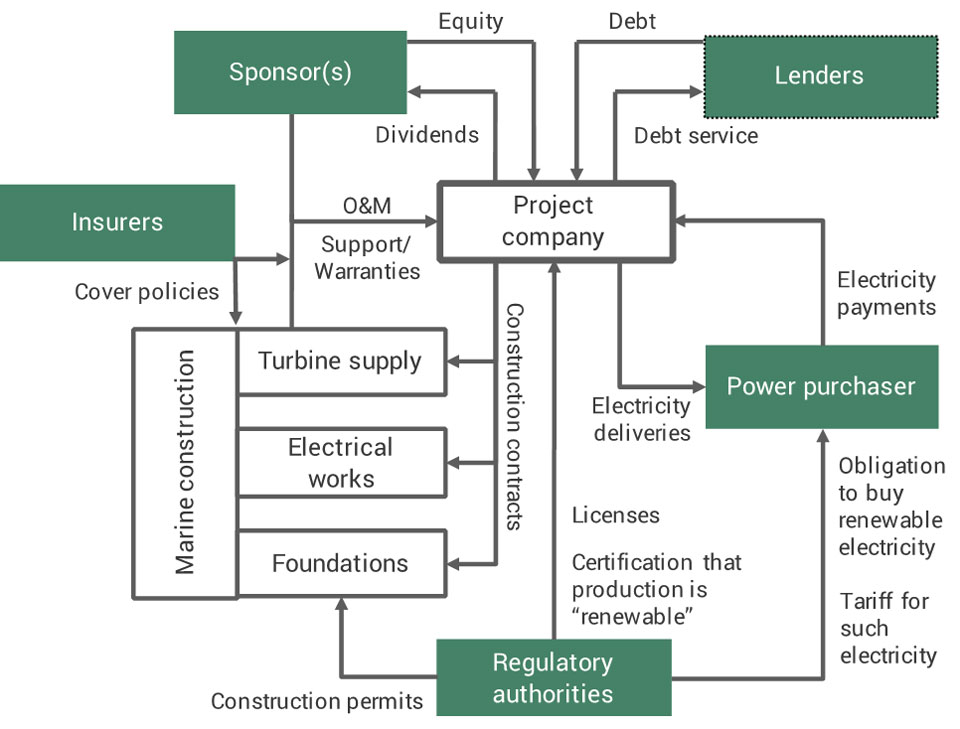

That meant very intrusive due diligence and direct involvement in all the contracts of these projects. The graph below summarizes the major contractual and/or regulatory relationships that exist in a project. In the case of project finance, banks want to make sure that every single one of the material contracts is fit for purpose (in application of the principle that a chain is only as strong as its weakest link) and in place at the time they commit the fund. As many of these relationships are conditional upon each other (the financing requires contracts to be effective, construction contracts become effective when proof of funding is provided) this usually means that all contracts need to be signed and confirmed at the same time: this is what is called “financial close” (or “FC”) in bank parlance. For balance sheet projects, things are a bit simpler as investors can commit the funding themselves towards contractors and not all contracts need to be in place on day one; their decision to go ahead with the project is called “final investment decision” (or “FID”).

Figure 7: Simplified contractual structure for an offshore wind project. Source: Green Giraffe. “Recent trends in offshore wind finance”, April 2019? S7

So how did banks manage to do it? This brings us back to Q7 and C-Power (in the next blog post).