This is the sixth part of what will be a 10–part series of blog posts, which will ultimately be published in full as a single report. Two parts will be published each week for the coming weeks. This part should only be read together with Part 5.

Earlier instalments:

Part 1 Part 2 Part 3 Part 4 Part 5

Construction phase

At FC/FID (financial close / final investment decision, as described in Part 5), the full amount required to build a project needs to be committed – typically around 2‑2.5 MEUR/MW nowadays, including the previously spent development costs – but obviously that amount is going to be site specific. That money can be provided by debt and equity (on terms as discussed below) and equity is often provided at that point in time by new parties that did not want to take development risk, but are willing to take fully contracted construction risk, especially if the project has been vetted in parallel by the debt providers, and buy into the project at that moment.

Within the overall budget, FC/FID is the moment where the development premium materialises, i.e. the profit that the developer can earn from completing the development cycle by bringing the project to FC/FID. That premium is the difference between the value of the project accepted by the new investors, and the overall development and construction budget – if positive. That amount can be paid out to the developer (in addition to the reimbursement of actual development costs) at that point in time, but is more usually partly subject to full completion of the project. It is determined by the price of acquisition of a stake in the project by new investors, if they enter at that moment, or it is an amount requested by the developer and validated by the banks, if they is no equity transaction. Banks accept to recognize a reasonable, market standard premium at that point in time, and to include it in the overall project budget they are funding.

- Main risks

- Construction delays (linked to weather, contractor failure, accidents, etc.);

- Cost overruns;

- Unavailability of grid connection on the planned date;

- Non-performance of turbines to specs.

- Timing and funding required

- Typically, 2 years to complete the project from FC/FID;

- Full construction budget, i.e. 2‑2.5 MEUR/MW, of which the equity should be fully funded upfront and the debt committed at FC/FID.

Operations phase

At completion (“commercial operation date”, or COD) a project is fully operational and starts generating cash flow at full rate. Many investors are only willing to take operational risk and buy stakes in offshore projects at this point in time (or rather, after a few months of operations, once performance is demonstrated). Naturally, return expectations are lower than for investors willing to take construction risk.

- Main risks

- Lower production than expected, due to less wind or lower technical performance;

- Lower prices than planned, for production sold on wholesale markets (this includes the period beyond the original PPA or feed-in tariff contract – investors now use a 30–35 year operational life to evaluate projects and will need to make assumptions about wholesale power prices to evaluate revenues after the PPA period; given that project debt has always been repaid at that point, these cash flows represent a material portion of the value of the project);

- More expensive operations and maintenance

- Grid unavailability.

- Timing and funding required:

- Long term operations for 20‑30 years (projects in 2011 would typically have assumed a 20 year operational life, but the industry has moved towards 35 years as a standard and some players now even expect that 40 years is achievable);

- Operating expenses typically represent 20–25% of revenues under price regimes that make offshore wind possible. The rest is available for debt service and/or equity remuneration

Investors in offshore wind

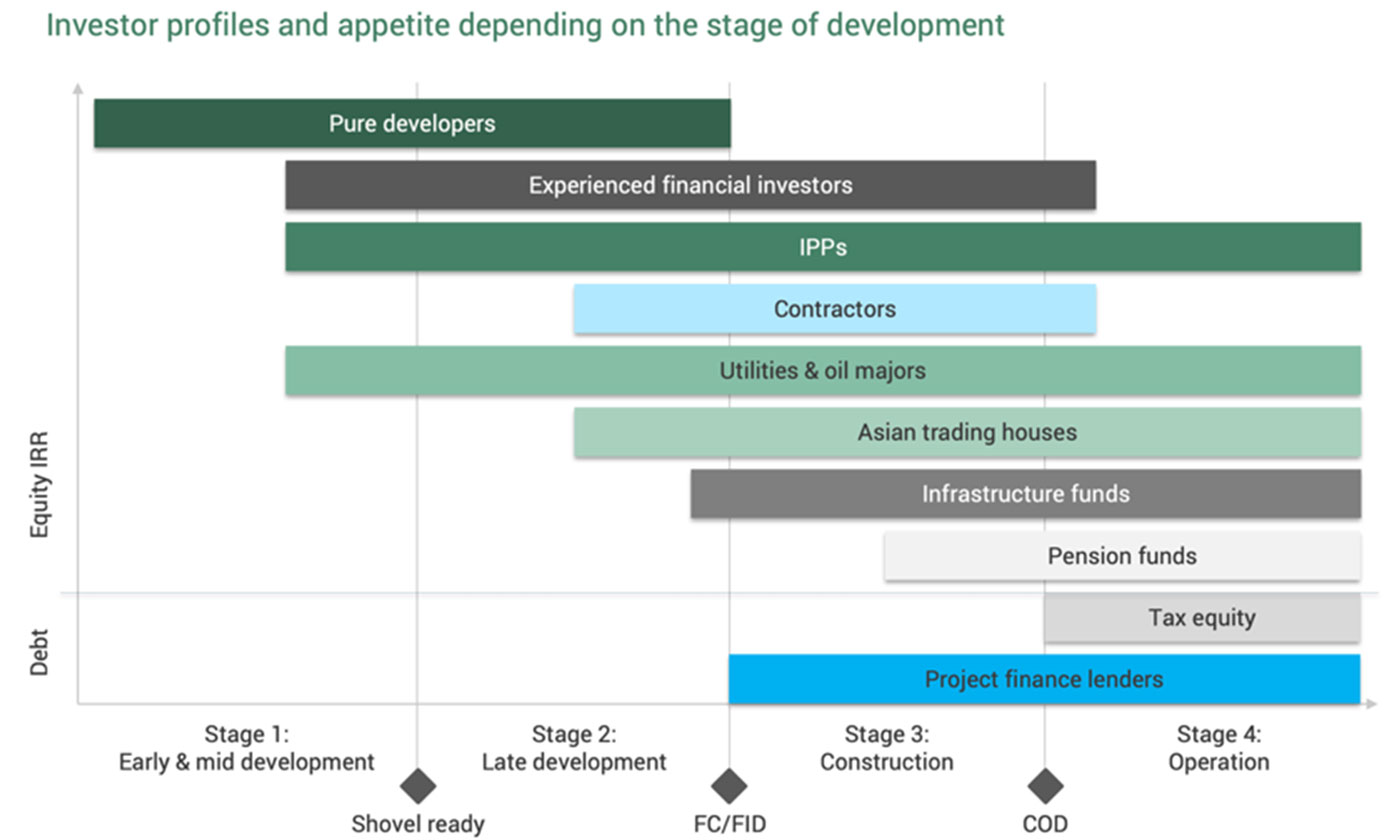

Given the very different profiles of each phase, in terms of time, money to be invested, and risk, investors often focus on different parts of the cycle.

Project development phases and investors

Source: Green Giraffe, “Recent trends in offshore wind finance”, April 2019, S12

- The most risk adverse investors will only come in when a project is built and operational – they also have the lowest return expectations and offer the most attractive “home” to such capital‑intensive projects. A minority stake in a recently completed offshore wind farm operated by a big utility with a fixed price tariff is the safest possible investment in offshore wind and the equity return expected by such passive investors represents the floor for returns in offshore wind – and any other investment proposal will involve more risk and thus potentially higher returns;

- Industrial players are typically involved across the value chain, but will focus on late development and construction, their core areas of competence, and will usually sell down their projects (at least partly) after completion;

- Smaller developers will focus on the early phases (site identification, permitting, stakeholder management) and tend to sell out once the required investments become larger – so either when they manage to bring projects to the “fully permitted” stage, or at FC/FID;

- Financial investors can typically be involved at most stages of development; individual players tend to focus on a given phase, and sell out as a project moves to the next stage.

Auctions are transforming the development period as in some cases (like in the Netherlands) the winning bids obtain a fully permitted project – but in other countries the development risk remains with the project owners (like in the UK or US), and auction participants closely match the “late development” stage in the graph above.

- Debt providers (“project finance lenders”) never take development risk and only come in at FC/FID – they will negotiate the terms of their participation during the late development period but will only provide funding once the project is fully permitted and all construction contracts are effective. We have already described their approach to projects earlier and will discuss their assessment of various project risks in the next section.

- Tax equity providers are a US peculiarity linked to the fact that support for renewable projects has come through tax policy, in the form of tax credits linked to actual production, which can be deducted from profits of the owner. As projects will typically not have taxable income for a long time (as they amortize their initial investment over several years), this can only be captured by otherwise profitable owners, which is not necessarily the case of wind project developers. So an industry has developed whereby the ownership of the project (at least from a tax perspective) is transferred to profitable parties who can make use of the tax credit and pay the corresponding amount (minus their remuneration) back to the “real” project owners. The tax credit beneficiaries only take operating risk on projects.

Equity returns

Expected returns on investment have followed a slowly declining trend over the past ten years, with both the underlying long term rates (unrelated to the industry) and the risk premium for offshore wind going down over the period.

The slow decline in the risk premium reflects the better understanding of the industry by external investors, combined with a solid track record of projects being built largely on time and on budget, and operating as expected or even slightly better overall (at least compared to the expectations, which were prudent to start with but have also become more aggressive over time as said track record has been available).

Return expectations for operational offshore wind farms 2010–2020

Source: Green Giraffe, “Recent trends in offshore wind finance”, April 2019, S13

For parties willing to take more risk than operations, the return are higher, as discussed in a later section, but have followed the same gentle downwards trend over the years. The extra yield compared to the base operational investment is generally proportionate to the additional risk taken, i.e. the market has been consistent in its pricing of the various risks, and nobody has done anything stupid to date.

That downwards trend in financing costs is what explains, more than anything else, how the industry was able to bring power prices down and bring the remarkable bid prices mentioned at the beginning of this document.

In a sense, the industry benefits from the fact that it is both inherently risky (construction in an unfavorable location, with multiple contractors that are relatively less known names) and perceived to be risky. This has led to continuous efforts to understand risks, mitigate them and price them correctly. And in fact, it is a rare project where nothing has gone wrong – and indeed as this is expected what matters to lenders and investors is the ability to react to incidents and prevent them from leading to actual serious delays or cost overruns.

The next blog post will discuss project risks in more detail.